Keeping your tax advisors informed, a checklist for the new year, life insurance as a charitable giving tool, and January Fundaversaries

Hello from the MCF!

Here we are at the start of 2026 — and we are deeply grateful for the opportunity to work alongside so many individuals, families, and businesses who care about making a positive difference in our community. Your generosity, thoughtfulness, and commitment to giving continue to shape and strengthen the place we all call home, and we are thankful to be part of that journey with you.

As a new year begins, we look forward with optimism and purpose. As always, we’re happy to share what’s trending across the charitable giving landscape and to offer ideas that may be helpful as you think about your goals for the year ahead. Whether you established a fund at the Morton Community Foundation years ago, started one more recently, or are simply exploring what charitable giving could look like in this next season of life, please know that MCF is here for you — ready to listen, answer questions, and help in any way we can.

New tax laws, local Phil and Barbara Kuhl Matching Gifts Fund incentive, and IL Gives Tax Credit (25% state income tax credit) effective in 2026 could significantly influence how charitable giving fits into your overall financial plan. The MCF team is happy to share information about key changes, including new deduction thresholds, limits for high-income donors, incentives for non-itemizers, and expanded opportunities for retirees. Consider sharing our updates with your tax advisors while also keeping the Morton Community Foundation in the loop. We stand ready to assist! Read More

A new year is the perfect time to bring intention and clarity to your charitable giving. Lean on the Morton Community Foundation’s checklist of three simple steps to help you reflect on past giving, understand how new tax laws may affect you, and set meaningful goals for the year ahead. You won’t regret getting an early start, and our team is here to help. Read More

Life insurance can be a powerful but often overlooked tool for achieving your charitable and legacy goals. The MCF is happy to work with you and your advisors to evaluate life insurance strategies to complement your donor-advised fund and other giving vehicles as part of your well-rounded charitable plan. Read More

Each month, we also like to highlight the various funds that were created in that same month throughout our history. Be sure to look for our January Fundaversaries feature below, celebrating the generosity of fund founders whose vision continues to make a difference today. Read More

Thank you for allowing us to serve as your home for charitable giving! We’d welcome a conversation about your goals for charitable giving in 2026 and beyond. Getting a jump on the planning process is a great way to start a new year off on the right foot.

Scott Witzig, Executive Director

Darcy Roecker, Administrative Manager

Charitable Tax Law Changes and Incentives for 2026: Keeping Your Tax Advisors in the Loop

At the Morton Community Foundation, we are honored to serve as your home for charitable giving. Whether you support a wide range of charitable organizations in our community and across the country, focus your giving on a few favorite local causes, collaborate with the MCF to invest in our region’s greatest needs, or all the above, we are here for you!

A new year presents an excellent opportunity to check in on your charitable giving priorities. This is the case every year, but it is especially important in 2026 not only because of the crucial priorities to improve our community’s quality of life, but also because of a few new tax laws that may impact charitable giving strategies for some people.

Here are the changes that you’ll want to be aware of, and, most importantly, share with your tax advisors as soon as possible to determine how these changes might impact your situation. Forward this article to your tax advisors or print it and take it to your next meeting.

Local and State Incentives to Note

The Illinois Gives Tax Credit Act continues to offer a meaningful incentive for charitable giving in our state. An additional $5 million in tax credits is available for 2026, providing donors the opportunity to receive a state income tax credit while supporting the causes they care about. In 2025, it took nearly the entire year for all credits to be used, but interest is growing, and we expect the available credits to be claimed more quickly in 2026. Because these dollars are limited and awarded on a first-come, first-served basis, please let us know if you’d like to discuss how you might benefit from this opportunity. CLICK HERE to learn more.

Phil and Barbara Kuhl have once again stepped forward with a generous opportunity to help grow permanent charitable resources at the Morton Community Foundation through their Grow-the-MCF Matching Gifts Fund. In 2026, a limited pool of $25,000 in matching dollars is available to match qualifying gifts to new or existing endowment funds at a rate of 50¢ on the dollar, up to a maximum $5,000 match. Because these matching dollars are limited and available on a first-come, first-served basis, we encourage interested donors to reach out as soon as possible to explore how their gift could be amplified through this special opportunity.

As always, a donation of appreciated stock may be your most tax effective way to give. For example, with CAT stock at a near-all-time high, you can make a significant impact for your favorite charity/fund, with no effect on your cash flow. CLICK HERE to learn more.

New Threshold to Itemize Charitable Deductions

One of the most significant shifts affects individual taxpayers who itemize their income tax deductions. Beginning this tax year, charitable contributions will only be deductible to the extent that they exceed 0.5% of a taxpayer’s adjusted gross income. In practical terms, this means that a portion of charitable giving will no longer generate a tax benefit. For example, a taxpayer with an adjusted gross income of $200,000 will see no deduction for the first $1,000 of charitable contributions made in a year. Only donations above that amount will be eligible for deduction, subject to existing percentage-of-income limits. This new rule functions much like a deductible in an insurance policy, raising the effective threshold for receiving a tax benefit and reducing the immediate incentive for smaller annual gifts among itemizers.

Limitation on Itemized Charitable Deductions for High-Income Taxpayers

High-income taxpayers will face an additional limitation through a new cap on the value of itemized charitable deductions. Even if a donor is in the highest federal income tax bracket, the tax benefit of a charitable deduction will be limited to 35 percent of the contribution. As a result, taxpayers in the 37 percent bracket will no longer be able to offset their income at their full marginal rate when making charitable gifts.

Good News for the 60% Cap

Another important change provides greater certainty for donors who make substantial cash contributions. The long-standing rule allowing cash gifts to qualified public charities to be deducted up to 60 percent of adjusted gross income has been made permanent. After satisfying the new 0.5% AGI floor, donors may continue to deduct cash contributions up to this level, while non-cash gifts or contributions to certain types of organizations remain subject to lower percentage limits. This permanence preserves a relatively generous framework for major philanthropy even as other rules become more restrictive.

New Incentive for Non-Itemizers

The new rules introduce an incentive for taxpayers who do not itemize deductions. Beginning with the 2026 tax year, individuals who claim the standard deduction will be allowed to take a limited charitable deduction above the line, meaning it reduces income before adjusted gross income is calculated. Single filers may deduct up to $1,000, while married couples filing jointly may deduct up to $2,000, provided the contributions are made in cash. This deduction is available in addition to the standard deduction and represents a meaningful expansion of tax benefits for charitable giving among non-itemizers, many of whom have received no tax benefit for donations in recent years. Note, however, that gifts to donor-advised funds are not eligible for this deduction, and neither are noncash gifts. This is unfortunate because both gifts to donor-advised funds and gifts of highly appreciated assets are useful tools that incentivize charitable giving.

QCDs May Be Even More Useful

Retirees and older taxpayers will also see an important adjustment through an increase in the Qualified Charitable Distribution limit. Beginning in 2026, the annual amount that can be transferred directly from an individual retirement account to a qualified charity will increase, allowing taxpayers age 70½ and older to direct more funds to charitable causes without including those distributions in taxable income. Because Qualified Charitable Distributions can also count toward required minimum distributions, this higher limit enhances a tax-efficient giving strategy that is unaffected by itemized deduction limits, adjusted gross income floors, or caps on deduction value.

Limitations on Corporate Charitable Deductions

Corporate donors are not exempt from the new framework. Starting in 2026, corporations may deduct charitable contributions only to the extent that those contributions exceed 1 percent of taxable income. Contributions below that threshold will not generate a current-year deduction, although amounts that exceed applicable limits may be carried forward to future tax years. This new floor is likely to influence corporate giving strategies, particularly for businesses that make consistent but relatively modest charitable contributions. The existing 10% cap on corporate charitable deductions remains in place.

Again, we strongly encourage you to forward this information to your tax advisors. Please loop us into the conversation so that we can work alongside your attorney, financial advisor, and CPA to ensure that you’re set up to meet your charitable goals for 2026 through strategies that also align with your tax, financial, and estate planning objectives. Whether you cc us on an email, ask your advisor to get in touch with us directly, or pull everyone together on a quick call or Zoom, MCF is here for you and looks forward to the conversation!

Contact Scott Witzig, Executive Director, at 309-291-0434, or email: switzig@mortoncommunityfoundation.org.

Get Started Now: Your 2026 Charitable Giving Checklist

Many people approach a new year with a genuine desire to be more intentional about their charitable giving. They know they want to make a difference, align their generosity with their values, and perhaps even involve their families—but they are often unsure where to begin. The combination of busy lives, changing tax laws, and an ever-growing number of worthy causes can make getting started feel overwhelming. The good news is that taking a few simple, thoughtful actions at the beginning of the year can bring clarity and confidence to your giving.

Here are three first steps to inspire you:

Consider reviewing your 2025 charitable contributions with the team at the Morton Community Foundation.

Looking back at last year’s giving can be surprisingly helpful, especially when guided by professionals who understand both philanthropy and the local community. MCF can help you see the real-world impact of your gifts, identify patterns in your giving, and highlight opportunities you may not have considered. This review also creates a natural bridge to planning your 2026 support, whether that means refining your focus, adjusting gift amounts, or exploring new charitable vehicles. Just as important, it allows you to begin thinking strategically about future years, helping ensure that your generosity grows in a way that is both meaningful and sustainable.

Talk with your tax advisors as soon as possible about whether and how the new tax laws might impact your situation.

Charitable giving is closely connected to tax and estate planning, and early conversations can help you make informed decisions before the year gets too far along. This is also an ideal time to revisit your estate plan and beneficiary designations. Many donors choose to include a gift to their donor-advised or other type of fund at the Morton Community Foundation in their wills, trusts, or beneficiary designations on retirement accounts or life insurance policies, creating a lasting legacy that reflects their values. Coordinating these updates with your tax advisor and MCF can ensure your charitable intentions are clearly documented, tax-efficient, and aligned with your overall financial and estate planning goals.

Set goals for your charitable involvement in 2026.

Rather than giving reactively, goal-setting allows you to be proactive and intentional about how you engage with the causes you care about. MCF can help you explore new and emerging charities, learn more about pressing needs in the community, and connect with organizations that align with your interests. Together, you and our team can create a plan for timing gifts throughout the year, whether through recurring contributions, single large gifts early in the year to help a favorite charity leap ahead, or strategic gifts of highly appreciated or complex assets. This approach not only makes giving more manageable but also helps ensure your generosity has the greatest possible impact.

As you look ahead, remember that you do not have to navigate charitable planning on your own. The Morton Community Foundation is here to serve as a trusted partner—whether you are just getting started, refining an existing plan, or thinking about the legacy you want to leave for future generations. We invite you to reach out anytime to ask questions, explore ideas, or take the next step in your giving journey. We are honored to help you turn your charitable intentions into meaningful, lasting impact.

Contact Scott Witzig, Executive Director, at 309-291-0434, or email: switzig@mortoncommunityfoundation.org.

Underappreciated and Overlooked: Why Life Insurance Matters to Charitable Giving

Even in an era when term life insurance policies may appear to dominate, many people still hold whole life, variable life, or universal life insurance policies. In many cases, when the original need for a policy goes away (e.g., children become independent or other assets have increased to fill risk gaps), a policyholder may be left wondering what to do with the policy.

Before cashing in a policy, it’s worth knowing that life insurance can play a meaningful and often overlooked role in charitable giving. A common approach is naming a charity as the beneficiary of a life insurance policy, either in full or in part. This strategy enables a donor to make a significant future gift at a relatively modest current cost of the annual premiums, particularly when the policy is already in force. For someone who has established a donor-advised or other type of fund at the Morton Community Foundation, this method may align well with estate planning goals because the death benefit passes directly to the fund outside of probate and may help reduce the taxable value of the estate.

Another way insurance policies are used in philanthropy is through the donation of an existing policy to MCF or another charitable organization. In this case, actual ownership of the policy is transferred to the charity, which then becomes both the owner and beneficiary. The donor may be eligible for an income tax deduction equal to the policy’s fair market value, generally based on its “interpolated terminal reserve” plus unearned premium, subject to applicable limitations. If the policy still requires premium payments, donors can continue funding those payments through additional tax-deductible contributions to the Morton Community Foundation or another charity, effectively converting future premium dollars into charitable gifts.

Finally, donors can use insurance creatively in more advanced charitable planning strategies. For example, a donor may purchase a new policy specifically for charitable purposes, often using annual contributions to fund premiums over time, or combine insurance with vehicles such as charitable trusts or donor-advised funds to enhance long-term giving impact. In some cases, insurance helps replace wealth passed to charity, so heirs are not financially disadvantaged, allowing donors to balance philanthropic intent with family goals. Through these approaches, insurance policies offer flexibility, leverage, and tax efficiency, making them a valuable tool in a well-rounded charitable giving plan.

If you are interested in learning more about how your life insurance policies can help you achieve your charitable goals, we encourage you to consult your financial advisor about the details and then reach out to the team at MCF. In particular, we are happy to help evaluate how life insurance gifts might fit alongside—or be integrated with—other giving vehicles, such as donor-advised funds and legacy funds. We are here for you!

Contact Scott Witzig, Executive Director, at 309-291-0434, or email: switzig@mortoncommunityfoundation.org.

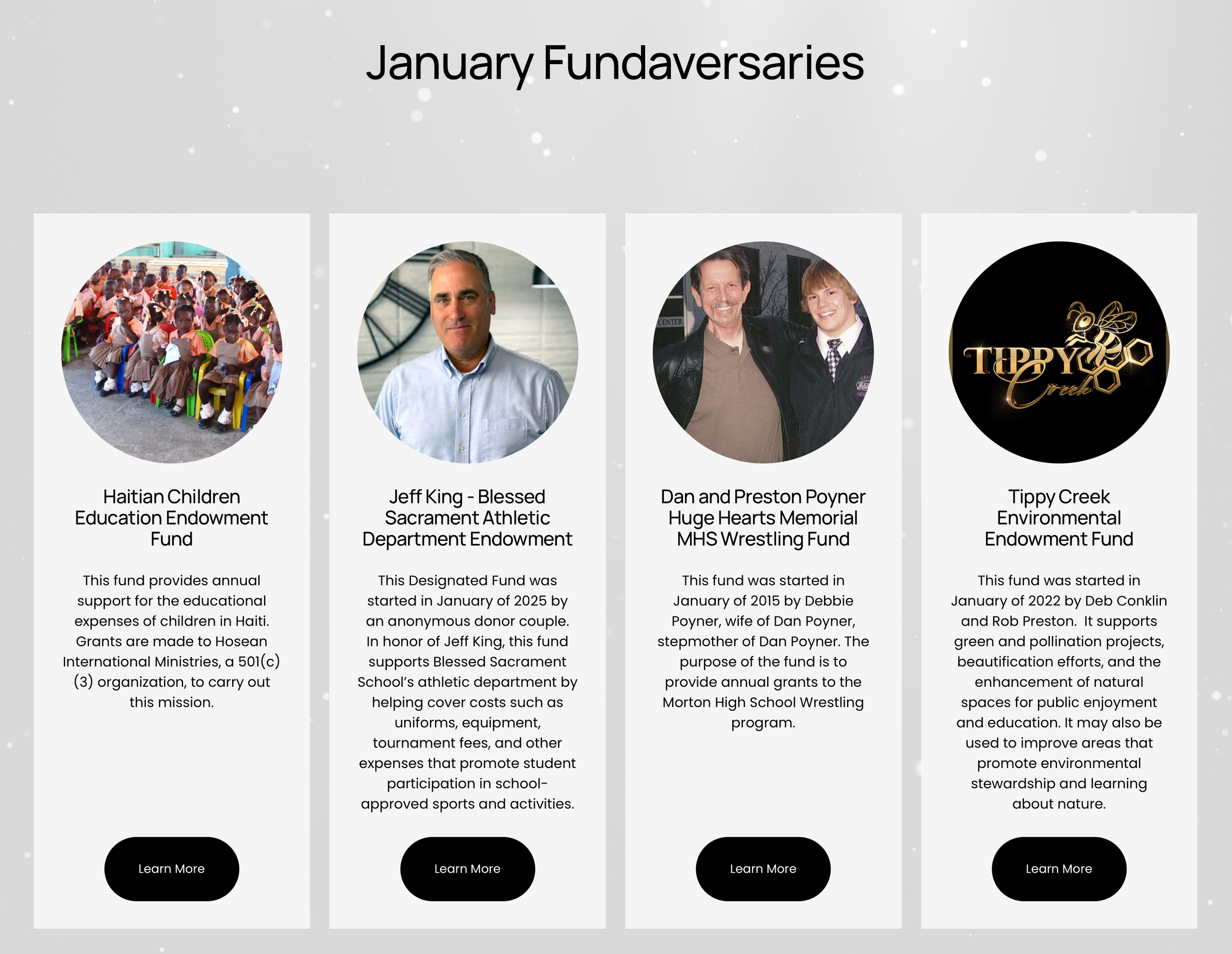

January Fundaversaries: Celebrating Lasting Impact

Each month, we celebrate the generosity of donors who chose to establish endowment funds at the Morton Community Foundation during that same month in years past. These January Fundaversaries reflect the many ways donors create lasting impact—supporting education, meeting community needs, honoring loved ones, and strengthening our community for generations to come.

January 2021 - Haitian Children Education Fund

January 2025 - Jeff King - Blessed Sacrament Athletic Dept. Fund

January 2015 - Dan and Preston Poyner Huge Hearts Memorial MHS Wrestling Fund

January 2022 - Tippy Creek Environmental Endowment Fund

Whether donors give to an existing endowment or create a fund of their own, these funds continue to tell powerful stories of generosity and foresight. We are grateful for the donors whose January fund anniversaries we celebrate and for the meaningful impact their funds continue to make year after year. CLICK HERE to learn more.

Would you like to discuss an idea you have for an endowment fund? Contact Scott Witzig, Executive Director, at 309-291-0434, or email: switzig@mortoncommunityfoundation.org.