Legacy gift - Blessed Sacrament School Tuition Assistance Fund, Balancing immediate and long-term community needs, Six tips for year end, and Reasons to celebrate donor-advised funds

Hello from the Morton Community Foundation!

We hope you enjoyed the final days of summer. The team at the Morton Community Foundation certainly appreciated hearing from so many of you over the last few months as you spent time with family and friends and the conversations turned to charitable giving. It was a busy mid-year as donors and their tax advisors scrambled to understand the new tax laws against a backdrop of increasing community needs.

Here’s what’s trending at the Morton Community Foundation:

Dorothy Fandel’s lifelong love for Blessed Sacrament School continues through her extraordinary $720,000 gift to the Blessed Sacrament School Tuition Assistance Endowment Fund. By leaving her entire estate to help local families, Dorothy’s legacy ensures that future generations of students can grow in faith and learning at the school she so deeply cherished. READ MORE

Many families spend time over the holidays focusing on their charitable giving priorities. If your family is among them, now is a good time to consider how both long-term and short-term planning can be important components of a comprehensive philanthropic strategy. The Morton Community Foundation can help! READ MORE

The questions keep coming–thank you! We appreciate many donors asking our team to explain just the basics of the new tax laws, with a particular focus on what might impact charitable giving plans through the remainder of 2025. Our team is happy to provide a quick overview. READ MORE

Donor-advised funds are just one of many vehicles available through the Morton Community Foundation to help you structure your charitable giving and support the causes you care about. With national DAF Day scheduled for October 9, this is a great time to review the many reasons to consider establishing your donor-advised fund at the MCF. READ MORE

We’re honored to work with so many individuals, families, and businesses to make a difference in the causes you care about. Thank you for the opportunity to work together. As always, please reach out anytime!

Your Morton Community Foundation Staff

Scott Witzig, Executive Director

Darcy Roecker, Administrative Manager

Contact us at: email: info@cfmorton.org • phone: 309-291-0434

Dorothy’s love for Blessed Sacrament School lives on through her $720,000 estate gift

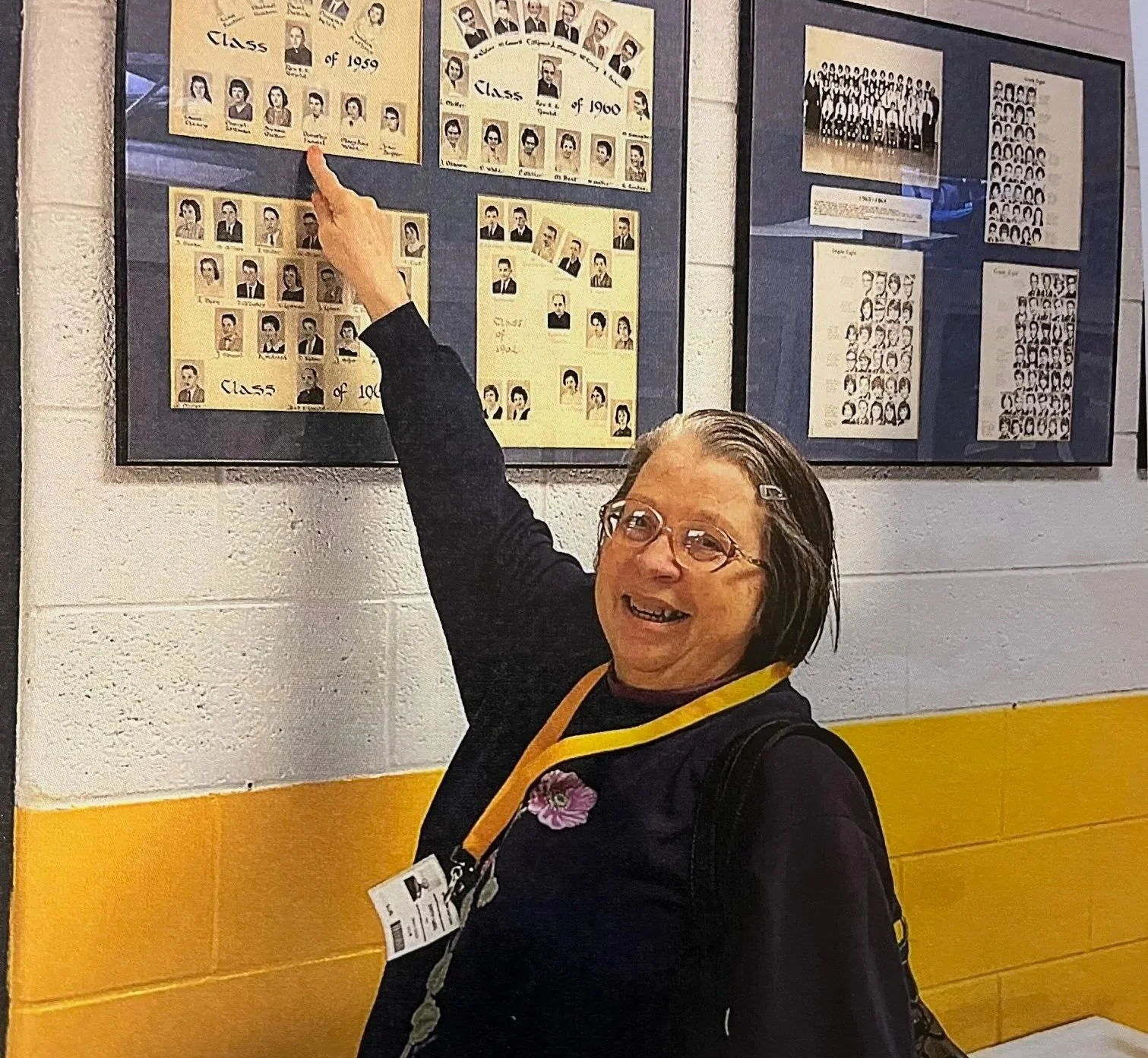

Dorothy was a devoted member of Blessed Sacrament Church who cared deeply for her faith community. She was especially proud to be part of the first 8th grade class to graduate from Blessed Sacrament School in 1959, and she often shared fond memories of her time there.

Dorothy, age 80, passed away on Tuesday, January 7, 2025, at her home in Morton. She was born May 7, 1944, in Whittemore, Iowa, to Walter and Cecilia (Besch) Fandel, and her family moved to Morton in 1955. Dorothy is survived by many cousins and her Blessed Sacrament Church family.

After graduating from Blessed Sacrament School and later the Academy of Our Lady Catholic High School in Peoria, Dorothy worked in Morton’s local grocery stores until her retirement. She and her parents lived a very modest life, yet through careful stewardship, they accumulated significant resources over the years.

It was Dorothy’s heartfelt wish to support families in our community by helping children attend the school she cherished. She demonstrated this by leaving her entire estate of $720,000 to the Blessed Sacrament School Tuition Assistance Fund.

To honor Dorothy’s memory, donations may be made to the Blessed Sacrament School Tuition Assistance Fund. Your generosity will carry forward her love for Blessed Sacrament School and help ensure that future generations of students grow in their faith, learning, and spiritual development.

Donations may be made to Blessed Sacrament School Tuition Assistance Fund in care of the Morton Community Foundation…DONATE HERE.

Balancing immediate and long-term support for your favorite community causes

At the Morton Community Foundation, we’re committed to working with individuals, families, and businesses to help make a difference in the causes you care about. Indeed, many people have at least a general idea of the community impact they’d like to achieve when they first establish a fund. If you’ve already established a donor-advised or other type of fund at the MCF, or if you are considering doing so, you might have a list of charities and priorities as your focus.

Our team can certainly help you achieve your charitable goals, including giving to charities you’ve supported for years, as well as introducing you to new initiatives and programs that fall within your areas of interest. Identifying recipients and goals for impact is certainly important in your philanthropy plan.

Here’s another question that’s important to answer: How long would you like your charitable dollars to be at work? The team at the Morton Community Foundation is equipped to help you with this component of your giving, too. Here are six questions we’ll consider when establishing your charitable giving plan and corresponding fund structure:

Are the causes and issues that matter most to you likely to represent short-term, immediate community needs, or community needs that will be important for generations?

Would you like your children, grandchildren, or other loved ones to help guide your charitable fund in the future?

Would you like to see and experience the results of your giving now, or are you more focused on establishing something lasting beyond your lifetime?

Are tax savings, estate planning goals, or retirement income needs part of what you’d like your charitable plan to support?

If you’re interested in both immediate impact and long-term legacy, what portion of your charitable fund would you like to see spent down versus preserved in perpetuity?

When you think about your charitable impact—whether in five years or fifty—what would make you feel your fund or funds at the Morton Community Foundation accomplished their purpose?

As we work together to consider these questions, the Morton Community Foundation team is happy to offer suggestions to help your decision-making process about the benefits of each type of structure, or a hybrid.

Many donors choose to combine strategies as they work with the Morton Community Foundation to build a portfolio of charitable giving vehicles to accomplish all aspects of their philanthropy goals. Here is an example:

A donor-advised fund to organize annual giving to favorite charities, including taking advantage of “bunching” techniques to front-load contributions to take advantage of itemizing charitable deductions.

A designated fund to support a specific favorite charity in perpetuity, ensuring that charitable funds will be preserved even if the charity falls on hard times.

Annual gifts to the Morton Community Foundation’s endowment fund so that critical issues can be addressed in perpetuity as the community’s needs change over time.

Beneficiary designations on traditional IRAs and other qualified retirement plans naming both the donor-advised fund and the Morton Community Foundation’s endowment fund to receive the proceeds.

Please reach out anytime. The Morton Community Foundation team is here to talk with you about your favorite charities, your philanthropy values, and your goals for impact. Together, we can create a charitable giving plan that reflects your vision, whether that means lasting forever, making a difference right now, or both.

Contact us at: email: info@cfmorton.org • phone: 309-291-0434

Six tips for your year-end game plan

With only a few months left in 2025, it is important to evaluate your philanthropy sooner rather than later. Recently-passed tax laws may throw a curveball into the financial planning strategies you’ve set in motion with your advisors.

Here are six tips to help you and your attorney, CPA, and financial advisor evaluate whether adjustments to your charitable plan might be in order. Of course, the team at the Morton Community Foundation would be honored to join your meeting for the charitable giving conversation. There are so many ways we can help!

Check out the new estate tax exemption.

The One Big Beautiful Bill Act (OBBBA) extended or “made permanent” many favorable tax provisions, notably the elevated estate tax exemption. In technical terms, under the new law, the 2025 estate tax exemption is $13.99 million for single filers and $27.98 million married filing jointly. In 2026, these numbers increase to $15 million and $30 million respectively. You may recall that the higher exemption was originally scheduled to sunset at the end of this year, which would have caused a lot more estates to be subject to tax. This, in turn, prompted many people to lean on charitable gifts in their wills and trusts to blunt the impact of estate taxes.

Keep planning!

If you are a high net worth individual, even though the estate tax exemption is staying high, this is no time to become complacent. Although no one knows what future tax legislation might look like, we all know that there will be tax legislation in the future. Today’s tax advantages will not be tomorrow’s tax advantages. Continue to talk with the Morton Community Foundation and your advisors about your charitable giving plans so you are ready to make adjustments when the laws change again.

Consider not making a change.

Above all, remember that financial motivations are not the top reason people support charities. That is certainly our experience at the Morton Community Foundation. So, if you were among the people who adjusted estate plans in anticipation of the lower estate tax exemption, consider retaining the larger bequest to your fund at the MCF or other charities. You’ll be doing a lot of good!

2025 is important if you itemize deductions on your income tax return.

If you itemize deductions on your income tax return, 2025 presents a window of opportunity! This is because the OBBBA increases the standard deduction in 2025. This is also because your itemized charitable deductions will be subject to a “floor” and cap starting in 2026. A technique called “bunching” could allow you to make big contributions to your donor-advised fund at the Morton Community Foundation in 2025 so that you can benefit from itemizing your deductions. In turn, over the coming years, you can use your donor-advised fund to support your favorite charities.

Stick to the basics.

Sure, a lot is changing, but a lot isn’t! Appreciated stock is still likely to be a much more tax-savvy gift to charity than cash, and it’s important to keep this top of mind. In addition, IRAs remain a powerful charitable planning tool. For instance, when you name a fund at the Morton Community Foundation as the beneficiary of an IRA, the gift avoids estate tax and income tax, both of which can hit your heirs hard.

Know the opportunities if you are 70 ½ or older.

If you are 70 ½ or older, the Qualified Charitable Distribution (“QCD”) is a great way to transfer up to $108,000 (2025’s per taxpayer limit) income-tax free to a qualified charity, including some types of funds at the Morton Community Foundation.

Please reach out to the Morton Community Foundation team. We’re honored to be your first call on all things charitable giving! Contact us at: email: info@cfmorton.org • phone: 309-291-0434

Donor-advised funds: So much to celebrate

Over the years, we have talked with a lot of people who are surprised to learn that they can set up such a wide variety of charitable giving vehicles at the Morton Community Foundation, including legacy gifts as well as lifetime giving vehicles such as donor-advised funds. What’s more, some people who have already established a donor-advised fund at a national financial institution don’t realize that they could have set up that donor-advised fund at the MCF, or that they can use their DAF at the national financial institution to recommend grants to support the Morton Community Foundation’s operations, or to support any of the over 140 different endowment funds that already exist at the MCF.

Establishing a donor-advised fund is a terrific first step toward establishing a comprehensive charitable giving plan. And October is a particularly good time to evaluate the role of a donor-advised fund as part of your philanthropic strategy. That’s because October 9 is DAF Day 2025, a national celebration of donor-advised funds and the impact they make in communities everywhere.

If you already have a donor-advised fund at a national financial institution, remember that you can recommend grants from your DAF to any of the over 140 different funds that support various causes in our community. And, the good news is that it’s never too late to transfer the fund to the Morton Community Foundation. You’ll be glad to know that donor-advised funds at the MCF can carry the same tax and administrative advantages as those at national firms, including:

–Consolidated tax reporting and full back-office administration

–Useful as a tool for “bunching” by front-loading several years of charitable giving into a single tax year to exceed the standard deduction threshold

–Dollars in the fund support favorite charities over time, enabling strategic giving

Here’s where a donor-advised fund at the Morton Community Foundation really stands out:

–Personal guidance and deep community knowledge of staff members who live and work in our region

–Close relationships with nonprofit leaders and organizations across many fields

–Tailored advice, local insights, and opportunities to collaborate with others who share donors’ interests

-Option for creating either an endowed or non-endowed Donor Advised Fund. Ask us about pros and cons for both options.

–Administrative fees support the Morton Community Foundation’s operations, which in turn help sustain and expand services for donors and the community

If you haven't yet set up a donor-advised fund at the Morton Community Foundation, we would welcome the opportunity to serve you! Here, your fund will be managed with the highest level of care, grounded in a true understanding of community needs, and supported by professionals who are committed not only to your goals but also to the health and vibrancy of our region. Together, we can make sure your charitable assets accomplish exactly what you intend—whether that means making an immediate difference, planning for the future, or both.

Contact us at: email: info@cfmorton.org • phone: 309-291-0434

The Morton Community Foundation is honored to serve as a resource and sounding board as you build your charitable plans and pursue your philanthropic objectives for making a difference in the community. This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice. Please consult your tax or legal advisor to learn how this information might apply to your own situation. Contact us at: email: info@cfmorton.org • phone: 309-291-0434