Morton Community Foundation - Est. 2000

25 Years of Gather, Grow, Grant

January Fundaversaries

-

Haitian Children Education Endowment Fund

This fund was started in January of 2021 by Charlie & Cheri Dean. It provides annual support for the educational expenses of children in Haiti. Grants are made to Hosean International Ministries, a 501(c)(3) organization, to carry out this mission.

-

Jeff King - Blessed Sacrament Athletic Department Endowment

This Designated Fund was started in January of 2025 by an anonymous donor couple. In honor of Jeff King, this fund supports Blessed Sacrament School’s athletic department by helping cover costs such as uniforms, equipment, tournament fees, and other expenses that promote student participation in school-approved sports and activities.

-

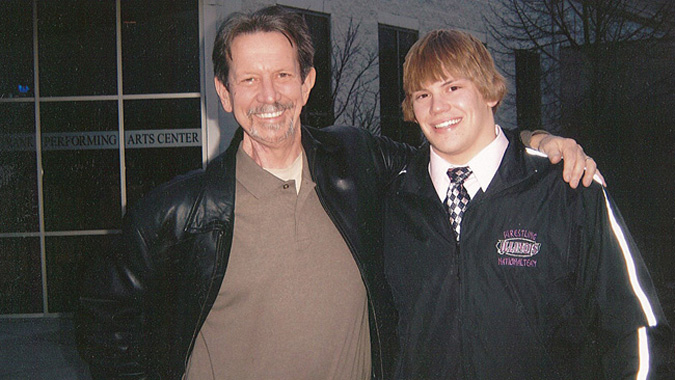

Dan and Preston Poyner Huge Hearts Memorial MHS Wrestling Fund

This fund was started in January of 2015 by Debbie Poyner, wife of Dan Poyner, stepmother of Dan Poyner. The purpose of the fund is to provide annual grants to the Morton High School Wrestling program.

-

Tippy Creek Environmental Endowment Fund

This fund was started in January of 2022 by Deb Conklin and Rob Preston. It supports green and pollination projects, beautification efforts, and the enhancement of natural spaces for public enjoyment and education. It may also be used to improve areas that promote environmental stewardship and learning about nature.

2026 Incentives Available to Multiply Your Impact

-

Through this program:

• Donors to qualified endowment funds can receive a 25% Illinois state tax credit on contributions.

• Tax credits are capped at $100,000 per donor annually (up to $400,000 in donations).

• $5 million in tax credits are available statewide for 2025, with 25% reserved for contributions of $25,000 or less.

• MCF can receive up to $3 million in qualified contributions.

Act quickly—credits are first-come, first-served.

-

The Caterpillar Foundation offers a year-round Matching Gifts Program that matches employee and U.S. retiree donations to eligible charities on a 1:1 basis, up to $10,000 per participant annually.

This means that if you are a Caterpillar employee or retiree, your donation to the Morton Community Foundation can be doubled, significantly enhancing your contribution to the community.

-

Donating appreciated stock offers unmatched tax benefits, such as avoiding capital gains tax on the appreciated value while deducting the full fair market value of stock held for more than 12 months.

For example, if you purchased Apple stock 10 years ago at $20 per share, a gift of 100 shares now worth $20,000 would have cost you just $2,000. You avoid taxes on $18,000 in gains and can deduct the full $20,000 as a charitable deduction for tax purposes.

Stock donations are easy, take minutes online, and are completely free for you and your advisor. Learn more on our website, or call for a no obligation discussion.

Make a Difference Today

These programs amplify your impact while offering significant tax benefits, especially if your donation qualifies for several, or all the above incentives. Whether supporting the Morton Public Library, education, or other local non-profit organizations, your gift goes further in 2025.

Dolly Parton’s Imagination Library

Free monthly books for every child under five who lives in Tazewell County.

Children under five years old who live in Tazewell County are now eligible to receive a free book each month through Dolly Parton’s Imagination Library program in partnership with Tazewell County Libraries. The free books are offered to all children under five in the county, regardless of family income.

Dolly Parton’s Imagination Library was launched in 1995 by The Dollywood Foundation, providing free books to children in Patron’s home area of Sevier County, Tennessee. The goal of the program is to inspire a love of books and reading among children.

Alissa Williams, Director of the Morton Public Library said, “Libraries are committed to education and learning. As research shows early literacy skills lead to success in school. We want all children to have easy access to books, so partnering with Imagination Library made sense.”

Tazewell County’s Imagination Library program is funded by donations. Anyone can donate to support the Tazewell County Imagination Library program. A fund has been established at the Morton Community Foundation and donations can be sent to Morton Community Foundation ATTN: Imagination Library Fund, 135 S. First Avenue, Morton, IL 61550. Donations may also be made online.

Genna Buhr, Director of Fondulac District Library added, “this program allows Tazewell County libraries another avenue to share the joy of books and the gift of reading in our community. We can’t wait to get books in the hands of children throughout Tazewell County.”

Children must be registered by a parent or guardian in order to receive the books. There is no charge to register or receive the books. Age-appropriate books are mailed directly to the homes of registered children each month. Parents or guardians may register their children online by filling out a brief form at imagination library.com. Registered children will begin receiving books at their home address about eight to 10 weeks after their forms are received. The first book distributed is always the children’s classic, “The Little Engine That Could.”

The program’s impact has been widely researched, and results demonstrate its positive impact on early childhood development and literacy skills. Penguin Random House is the exclusive publisher of Dolly Parton’s Imagination Library. For more information, please visit www.imaginationlibrary.com.

Trusted for Good

Giving generously—to support your favorite cause or establish a permanent legacy—requires trust. At the Morton Community Foundation, we don’t take that trust lightly. Whether you’re starting an endowment or donating to one of our existing funds, you can be confident knowing we’ve met the highest standards for accountability, transparency, and ethical stewardship.

These commitments are reflected in the memberships, accreditations, and designations you’ll see recognized in the footer of every page of our website.

We are proud to be accredited for National Standards for U.S. Community Foundations, the nation’s highest measure of excellence in the field. This rigorous accreditation, overseen by the National Standards Board (a subsidiary of the Council on Foundations), confirms that we meet strict legal, ethical, and operational standards.

We’re proud members of the Alliance of Illinois Community Foundations, a statewide network that fosters collaboration, learning, and advocacy among community foundations in Illinois. This membership keeps us connected to best practices and collective impact strategies.

Candid (formerly GuideStar) has awarded us the Gold Seal of Transparency, recognizing our commitment to openly sharing our goals, financials, and impact. It’s a sign to donors that we’re accountable and aligned with best nonprofit practices.

We’ve earned a 4-Star Rating from Charity Navigator, their highest possible score. This distinction reflects our strong financial health, accountability, and transparency—so you can give with confidence.

As an active member of the Morton Chamber of Commerce, we’re deeply connected to our local business and civic community. Our membership reflects our commitment to supporting local partnerships and advancing the economic and social vitality of Morton.